taxes to go up in 2021

The standard deduction for 2021 increased to 12550 for single filers and 25100 for married couples filing jointly. For tax year 2021 the CARES Act allows taxpayers to deduct up to 100 of their adjusted gross income AGI for charitable contributions up from the standard 60 of AGI in.

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

How much will taxes go up in 2021.

. However for 2022 if you make the same salary your. Tax Foundation General Equilibrium Model January 2021. Global minimum tax.

Although the tax rates didnt change the income tax brackets for 2021 are slightly wider than for 2020. The proposal read about it here along with US negotiations with other G20 nations would increase the minimum tax on US corporations to 21 and. Why did my taxes go up on my paycheck 2021.

The seven federal tax brackets for tax year 2021. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. 20 with AGI up to 22000 10 with AGI up to 34000 38 Frequently Asked Questions What were the 2021 tax brackets.

New Tax Rates Local Tax Rate Changes There are no local tax rates increase for tax year 2021 however two counties St Marys and Washingtons have decreased their local. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523600 628300 for married filing jointlyMeanwhile. Biden has said that he would raise taxes for the top income bracket to nearly 40 percent from 37 percent and increase the corporate tax rate to 28 percent from 21 percent.

Income tax brackets increased in 2021 to account for. Each annual increase is small but it adds up to a. 147000 in 2024 62 on first 141800 in.

For example if you are a single taxpayer who makes 41000 per year you were in the 22 percent tax bracket for 2021. For children under 6 the amount jumped to 3600. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

2021-2022 FICA tax rates and limits Employer â pay Social Security Tax OASDI 2 nothing more than the first 142800 in 2021. To help Canadians in the future the Canada Revenue Agency is taking out increasing CPP premiums from 2019 to 2023. For tax year 2021 participants with family coverage the floor for the annual deductible is 4800 up from 4750 in 2020.

However the deductible cannot be more than. The Joint Committee on Taxation released a chart indicating that federal taxes for those making between 10000 and 30000 would actually go up starting in 2021. After 11302022 TurboTax Live Full Service customers will be able to amend their.

Raising the corporate rate to 25 percent would raise about 5221 billion between 2022 and 2031 on a.

What You Need To Know About Taxes In 2021 Westport Federal Credit Union

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

Taxes Are Going Up Are You Prepared

2022 Tax Guide How To File Your 2021 Taxes

Craig S 2022 Sales Taxes Up Through First Three Months Of The Year Craigdailypress Com

Worried About Higher Taxes In 2021 Fundx Insights

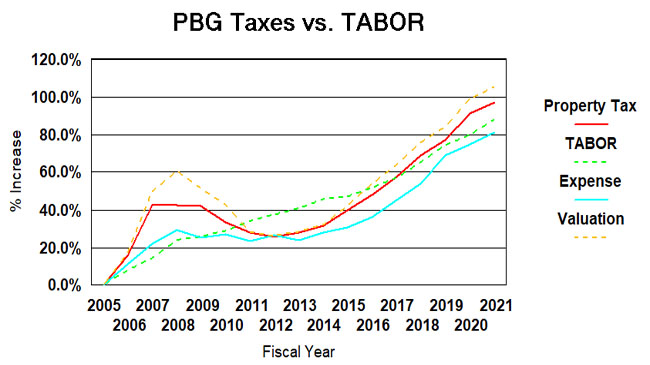

Modest 3 1 Tax Increase In 2021 Budget Pbg Watch

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Five 2021 Tax Filing Tips For Clients Wealth Management

Watch For Your New 2021 Tax Assessment Pierce Prairie Post

Can You File An Extension For Your 2021 Taxes Wcnc Com

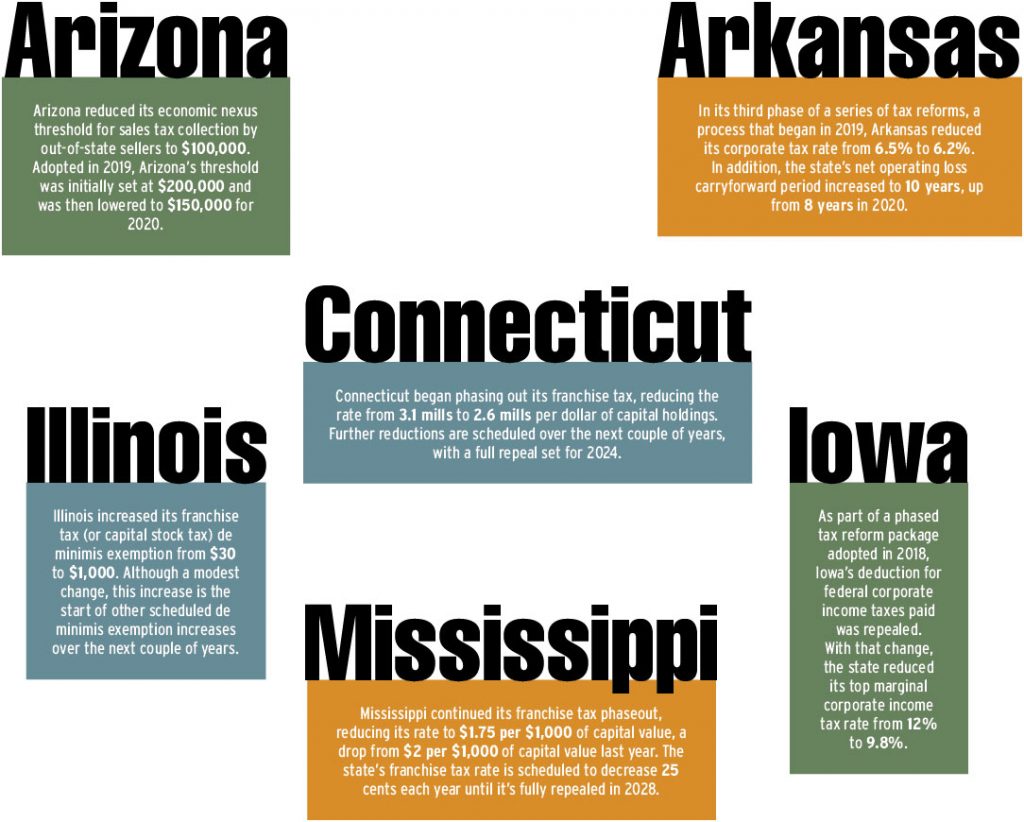

State Tax Updates In 2021 Tax Executive

Rachel Wolf On Twitter 1 People Think Taxes Will Go Up To Pay For The Pandemic But They Re Not Expecting Them To Go Up This Year Https T Co Hyu863llcm Twitter

Financial Planning Archives Adventure Wealth Advisors

Are Taxes Going Up Trusttree Financial

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Why Your Portland Property Taxes Climbed This Much You Voted For It Oregonlive Com

With Taxes Going Up Cannabis Operators Threaten California Weed Party